New Delhi3 minutes ago

- Copy link

Finance Minister Nirmala Sitharaman said that now 5%, 12%, 18% and 28% slabs of GST have been reduced to two. Now there will be a slab of only 5% and 18%.

Now cricket fans will have to pay more money to watch IPL matches in the stadium, as the government has increased the GST rate from 28% to 40%. It was decided in the 56th meeting of the GST Council. Finance Minister Nirmala Sitharaman gave this information on 3 September.

The new tax system has considered a luxury activity watching IPL and has kept it in the category of services like tobacco products and casinos. However, 18% GST will still be applicable on general cricket matches. That is, this change is only for premium sports events.

On the other hand, cinema tickets up to Rs 100 will have only 5% GST, which was earlier 12%. But more than 100 rupees tickets will be charged as before 18% GST. At the same time, GST has been reduced to 5% on services related to hotel booking, beauty and health.

The 56th meeting of the GST Council was held in New Delhi under the chairmanship of Finance Minister Nirmala Sitharaman.

Understand the changes in the service sector with calculations…

1. How will IPL ticket prices change with changes in GST?

Suppose the IPL ticket price is 1000 rupees…

- First: 1000 + (28% i.e. 280 rupees) = 1280 rupees.

- Now: 1000 + (40% i.e. 400 rupees) = 1400 rupees.

- increase: 1400-1280 = 120 rupees per ticket.

Similarly, if the price of IPL ticket is Rs 2000, then…

- First: 2000 + (28% i.e. 560 rupees) = 2560 rupees.

- Now: 2000 + (40% i.e. 800 rupees) = 2800 rupees.

- increase: 2800-2560 = Rs 240 per ticket.

2. How will the price of cinema tickets change with changes in GST?

The prices of tickets up to Rs 100 will decrease. At the same time, tickets of more than 100 rupees have not changed. Suppose the base price of a ticket is 80 rupees:

- First: 80 + (12% i.e. 9.60 rupees) = 89.60 rupees.

- Now: 80 + (5% i.e. 4 rupees) = 84 rupees.

- Savings: 89.60 – 84 = 5.60 rupees per ticket.

Many multiplex operators offer tickets on work days for Rs 99. Now these tickets can be cheap.

3. How will the change in GST change the fare to stay in the hotel?

- First: 12% tax

- Now: 5% tax

- Condition: This will be applicable only when a day’s fare is Rs 7500 or less.

- Benefit: Cheap hotels and resorts will now become cheap. For example, a room of 5000 rupees used to be 5600 rupees earlier, now you will get for 5250 rupees.

4. How cheap will the changes in GST be services like gym, salon?

- First: 18% tax

- Now: 5% tax

- What is included: Gym, barber shop, salon, yoga center etc.

- Benefit: Now the gym and salons will become cheap. For example, earlier Rs 180 was taxed on gym fees of 1000 rupees, now only 50 rupees. The same will happen in the gym.

The government has reduced GST from 18% to 5% on services like gym and saloon.

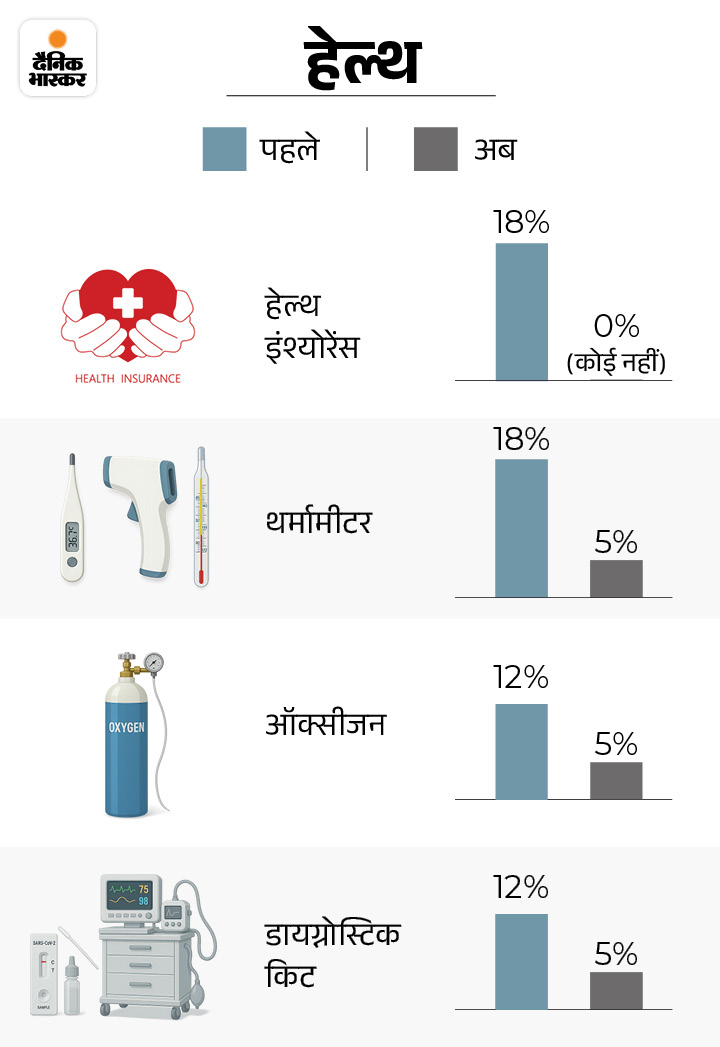

5. How much cheap will insurance services be with changes in GST?

- What a discount: No tax on life insurance (term, ULIP) and Health Insurance (Domestic and Senior Citizens).

- Benefit: The insurance premium will be cheaper. 1800 will be saved on a policy of Rs 10,000, which will help in increasing the scope of insurance.

6. How to change the GST change and delivery services?

- Affordable Home: Projects like 12% to 5% (PMAY).

- local delivery: 18% to 5% (grocery delivery).

- Benefit: Cheap houses and online orders will be cheap.

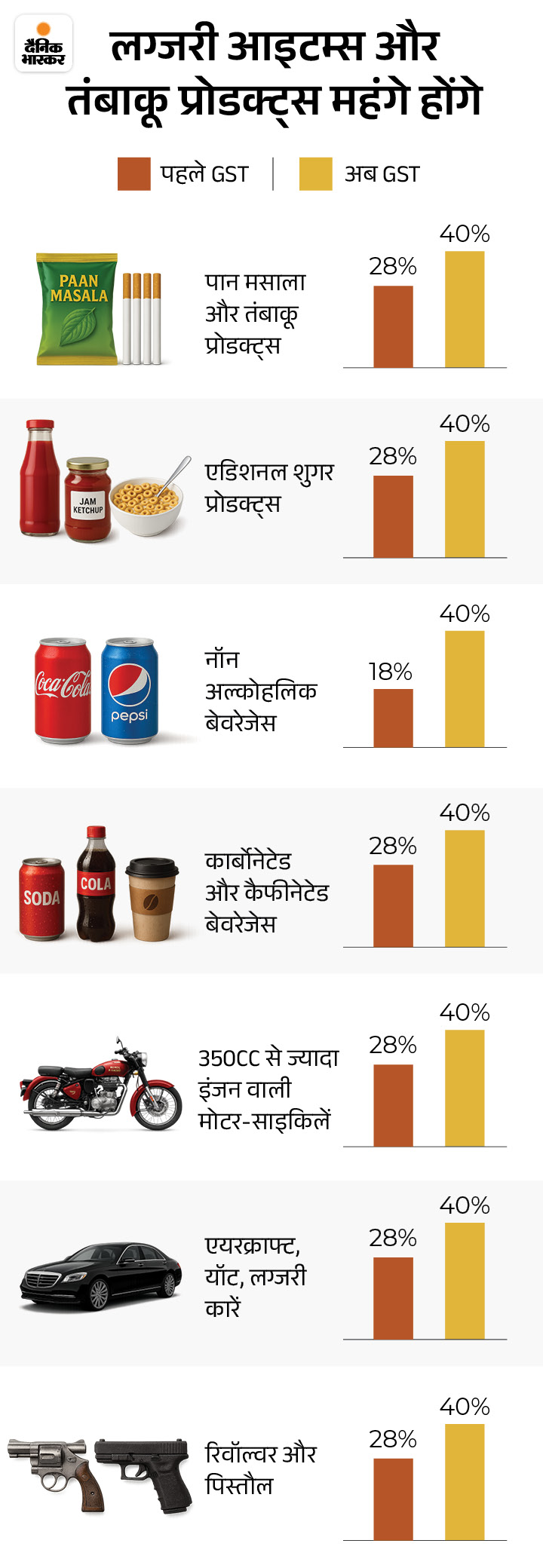

Now know what cheap will be expensive in Goods?

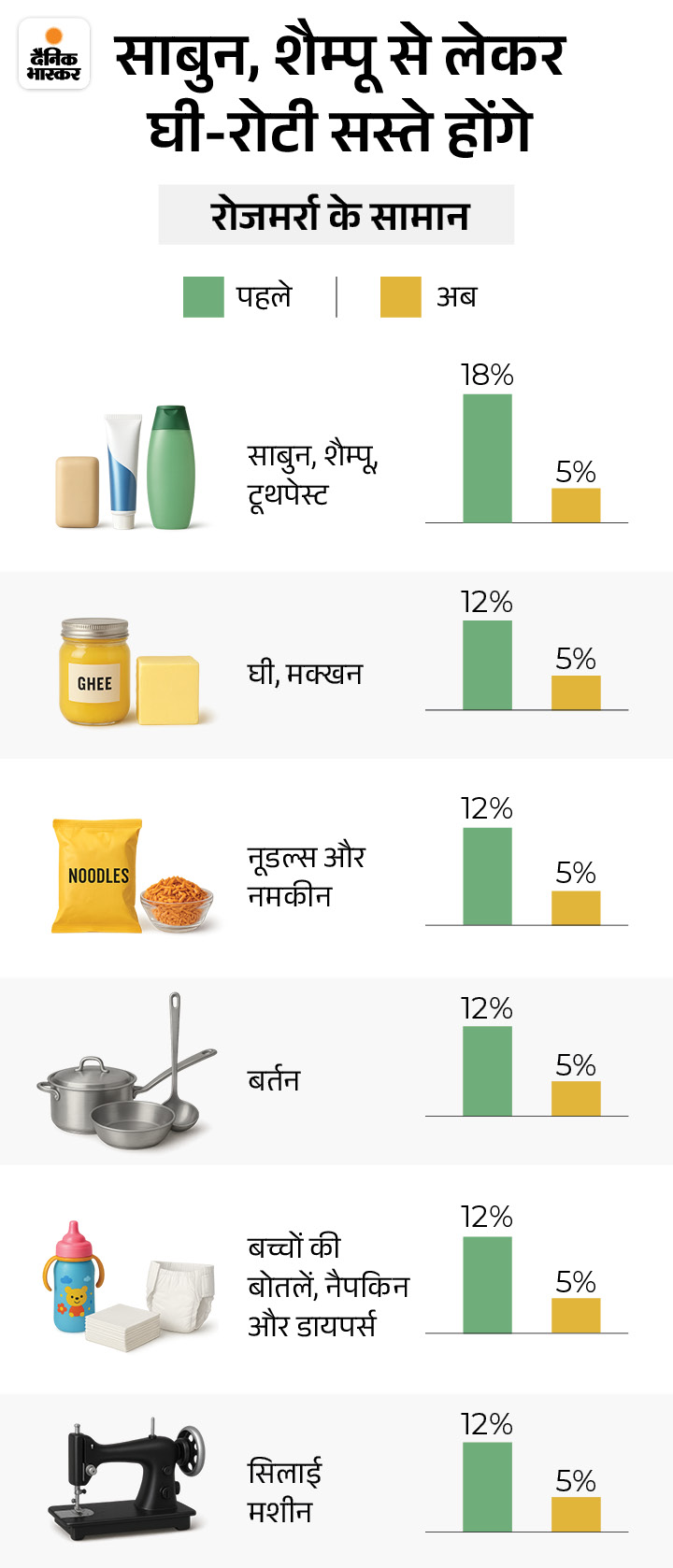

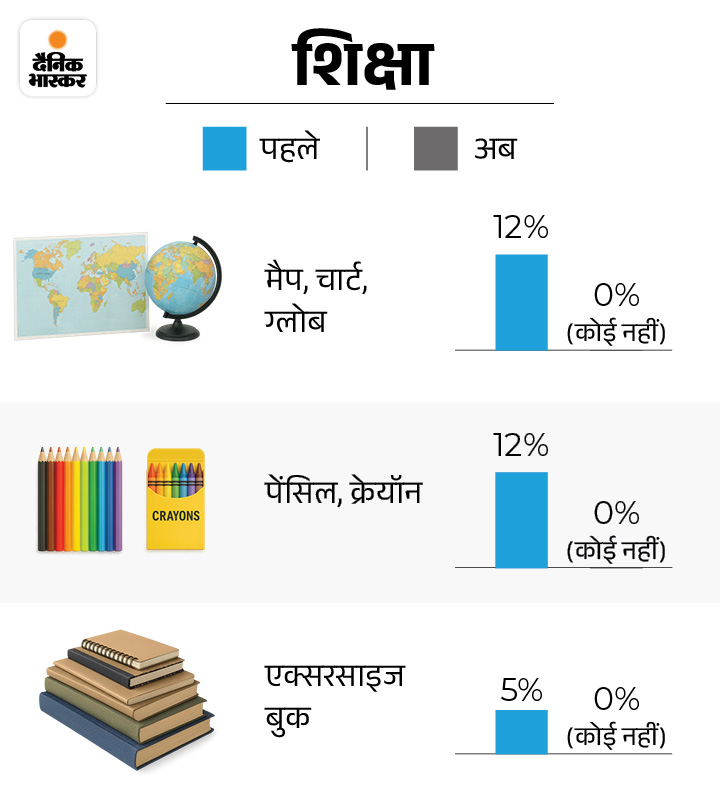

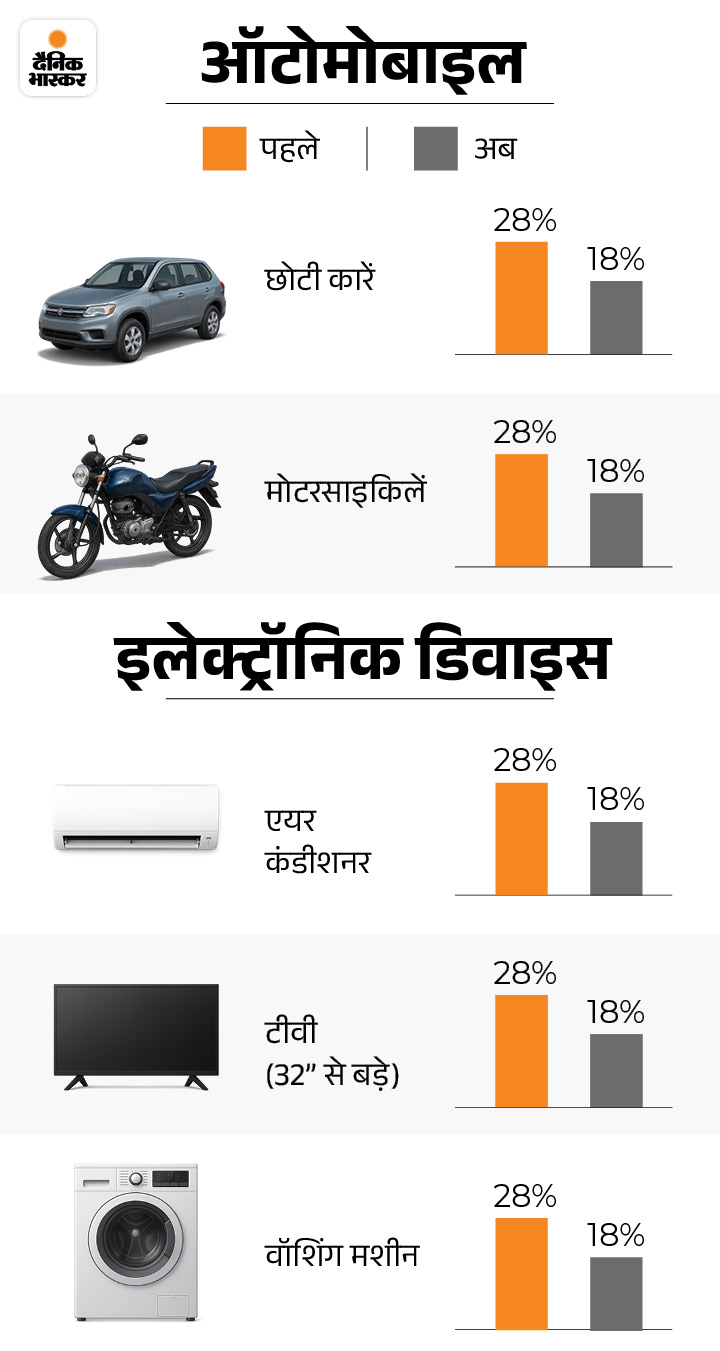

Due to the two slabs 5% and 18% instead of 4 of GST, it will also be cheap to common needs such as soap, shampoo, car. See what cheap and expensive will be in graphics here …

New slabs will be implemented from 22 September

The Finance Minister said that the new slabs will be implemented on the first day of Navratri, ie from 22 September. However, the new 40% GST rate on tobacco goods will not be applicable yet.

The purpose of these changes is to give relief to the common man, support small businesses and reduce their use by increasing taxes on harmful products such as tobacco.

,

Read this news too …

1. Bread, Paratha, Milk, Health-Life Insurance Tax Free: Now only two slabs of GST 5% and 18%; Changes will be applicable from 22 September

Now only two slabs instead of 4 of GST will be 5% and 18%. This will also make common needs such as soap, AC, car with shampoo. It was decided in the 56th meeting of the GST Council. Finance Minister Nirmala Sitharaman gave this information on 3 September.

Finance Minister Sitharaman said that many food items including milk, roti, paratha, chhena will be GST free. At the same time, individual health and life insurance will also not be taxed. 33 Life -saving medicines, rare diseases and medicines for serious diseases will also be tax free. Read full news

2. needs like milk, medicine, TV-AC cheap, hobbies expensive: GST change will now save how many rupees in your pocket

The Diwali gift that PM Modi promised in the August 15 speech has got the approval of the GST Council. GST will now have only two slabs- 5% and 18%. The new changes will make 5 categories of milk-ghee, TV-AC, car-bike, insurance requirements cheaper. However, there will be another slab of 40% for hobbies and luxury. Read full news